Algo trading is also known as Algorithmic trading or automated trading, is a method of executing orders using a computer program that follows a defined set of instructions (an algorithm) to place a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader. The defined sets of instructions broadly includes three steps:

- evaluates different variables like timing, price, quantity, volume

- run a mathematical model

- place appropriate trades if required (defined conditions are met)

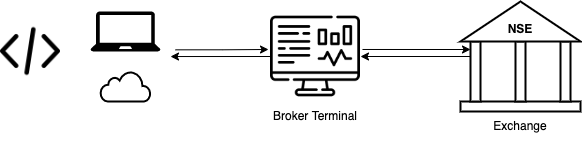

A simple algo trader can have instructions like buy 50 shares of a stock if its price goes below 52 week average, or sell 50 share of holding stock if its price goes beyond 52 week high. A computer program can be designed to execute these steps and thus eliminate the need of human interaction. A typical infrastructure would consist three components.

- A computer program which running on a laptop or deployed over cloud.

- A broker terminal

- Stock Exchange

The program connects to broker terminal which is further connected to stock exchange. The broker fetches market rates from the exchange and passes it on to the program. The program then runs computations on this data and send buy/sell trade signals to broker. These signals are relayed to the stock exchange by the broker.

As the code runs without human oversight there are multiple things which can go wrong during the market hours, for instance there can be large movement in the prices or there can be a connection error. To test the performance of algo under these extreme circumstances we perform stress testing. Stress testing is a computer simulation technique used to test the algorithm against drastic scenarios. Such testing is used to help gauge the risk and help evaluate safe guards and controls. It uses multiple scenarios which can be mix of historical, hypothetical, or simulated data. While testing, the algo is run over these scenarios to gauge its performance over some key performance metrices (KPIs). The scenarios thus should be designed to cover all internal and external factors which might have an impact on algorithm’s KPIs.

Designing Stress Test’s Scenarios

Let’s design stress testing scenarios for a sample trading algorithm. I covered an algorithm implementing Short Straddle Strategy here, it can serve as a good example. The short straddle algo buys and sells NIFTY options to generate profits.

Key Performance Index (KPIs)

KPIs for this algorithm will be how much profit or loss was incurred. We will be testing on unfavourable scenarios and so we would be more interested in knowing the losses and that too what would be the max loss incurred. Thus the first KPI can be Max Loss.

Loss distribution is also a key indicator of algo’s performance. While testing it on different scenarios we can measure what is the rupee loss incurred per unit of time, i.e. how much money was lost during 5 minutes of distress and if that is static, linear or exponential. Similarly we can also measure loss per unit of movement in NIFTY index.

The algo might have some safeguards built in which basically sense upcoming unfavourable event and suspends trading to avoid losses due to same. One of the key metric would be to check the reaction time of these safe guards, i.e. what level of losses are already incurred before these safe guards kicks in.

To summarize we defined three KPIs for the algo:

- Max Loss

- Loss per unit time and per unit of NIFTY movement

- Reaction time of safeguards

Unfavourable Events

Unfavourable events can be internal or external to the system.

External Events:

External events are events which occur outside the system and have impact on algo’s KPIs. External events can include market movements and volatility, liquidity or price discrepancies.

Marker Movements can be categorized into three forms

- Upward movement

- Downward movement

- Sideways movement (flat movement)

Market Volatility can be categorized into three forms as well:

- Below Average

- Average

- Above Average

The market movements can be combined with each volatility to have 9 different scenarios, for instance one scenario can be Upward movement with below average volatility, Sideways movement with above average volatility and so on.

Options’ prices are heavily dependent on Implied Volatility, thus change in IV should be included as one of the external events.

Implied Volatility can be:

- Below Average

- Average

- Above Average

Liquidity can have an impact on performance as it will limit algo’s ability to scale its current position or square off existing position.

Liquidity can be modelled as following:

- Normal Liquidity

- Dried Up Liquidity (Close to no liquidity)

There are times when market experiences absurd prices of an instrument, for instance an instrument which should have been priced are say ₹100 got sold for ₹2. In such cases if the algo hold such position a loss of 98% will be reflected and might lead to stop loss being triggered. The prices come back to normal very quickly but stop loss once triggered will stay active and might exit position at a loss. Thus occurrences of such freak prices should be included in external events.

Internal Events:

These events occur inside of the trading system but can have impact on KPIs. The system includes: computer program, broker terminal and the exchange. All three are connected via internet.

In such setup one of the internal event can be connection error between Algo and Broker or Broker and Exchange. The connection error can also be of two types, delayed signals or complete disconnection. Thus combining all we can have four types of events:

- Delayed Signal between Algo and Broker

- Delayed signals between Broker and Exchange

- Connection Loss between Algo and Broker

- Connection Loss Between Broker and Exchange

Another event can be high computation time for the algo, if algo takes a lot of time to run computation, any trade signals it generates will be delayed and might lead to unfavourable event. Factoring in such high computation time error into stress testing thus would be a good idea.

To summarize there can be five internal events:

- Delayed Signal between Algo and Broker

- Delayed signals between Broker and Exchange

- Connection Loss between Algo and Broker

- Connection Loss Between Broker and Exchange

- High computation time by algo

Combining Internal and External events:

The internal and external events are independent in nature and so two or more of them occurring at same time is a possibility and would also be more adverse to the algo. For example there might be a case the market is having a downward movement and there is a connection loss between broker and exchange. Thus combining these independent events will lead to even more scenarios.

Conclusion

Algo trading can be implemented by reducing a trading plan into a set of instructions and converting it into a computer. The program can directly interact with broker for market data and trades thus eliminating need of human intervention. Lack of human control can lead to drastic losses in case of an unfavourable event and thus to test algo for such events we conduct stress testing.

Under stress testing we define KPI of the algo which might include Max Loss and Loss Distribution. The algo is run under a simulated environment where it is subject to different possible scenarios. These scenarios are can be external, internal or combination of both.