Goals Based Investing (GBI) is an alternate approach to investing and wealth management. As per GBI, the objective of financial investments should be to attain specific life goals rather than generating highest possible returns. These goals range from short term like buying a phone or a car to long term like saving for children’s education or building a retirement corpus. It highlights that the purpose of savings and investments is to fulfill future goals and all parameters of investment like risk appetite and asset allocation should be based on these goals.

Like in an IPL tournament the objective of any team is to land on top of the table, this objective is achieved by winning most matches and not just by hitting maximum runs. A team which won the most matches ranks higher on the table even if the other teams scored more runs overall or had better Net Run Rate. Teams having this clarity of goals are most aligned towards them and have better chances of winning the tournament. Goals Based Investing relates the same to individuals, i.e., having clear goals and aligning investments to fulfill them leads to a better life.

How to implement GBI in personal life?

List your Goals

It all starts with defining your goals, what you want in your life and when you want those things. Yes, it seems like a daunting task, but to make things easier we can start by looking at some obvious things, like we would retire by age of 60 and will need a retirement corpus by then, we would plan to fund children’s education when they turn 18, we would like to buy a big house when we turn 40 and so on. Once the longer-term goals are defined we can turn our attention to short term and lifestyle based goals like, we would like to buy a new car in three years’ time, we would like to go on a foreign trip after two years, we would like to re do furniture of our house next year, we would want to buy a new phone this year and the list continues. The beauty here is that we don’t need to list out all our plans at once, we can just start by listing a few and start planning towards them. In future as and when required we can amend or add new goals. To begin with, we just need to get into the habit of describing the goal and planning towards it.

Plan to accomplish your goals

The goals we listed are like matches in an IPL season and we would want to accomplish all of them. But not all matches in a season are same. Some matches are more crucial than others, we definitely want to win the crucial ones while we can assume some risk in others. Some matches are against weaker teams, and we have some leverage to be more aggressive while others we need to be careful. Similarly, not all goals are same. Some goals are important for us like having a good retirement corpus or having funds for children’s education while others have less priority like buying a big house. In some goals we have leverage like going on a foreign trip, even if we are able to accumulate only 80% of the planned budget, we can always choose a more economical destination.

Once we have defined our goals, we can start to build a plan to accomplish them. Consider a crucial goal of buying a new car in three years’ time, we definitely want to buy a new car and will certainly need to have appropriate savings by then. It is similar to a team playing a crucial match and chasing a respectable total say 160 runs in twenty overs. The team here can’t afford to lose the match and thus would like to give charge to their most reliable batsmen. These batsmen might not be able to slog but has the best chances of chasing down the target. Similarly, to achieve the goal we would start saving a fixed amount each month and would invest that amount in a risk free / low risk instrument, an instrument which probably won’t give us best return in market but will generate appropriate savings in the given time frame most reliably.

Now consider another goal of say having a foreign trip in two years, again we definitely want to achieve it but we have variable target budget. This would be similar to a team batting first against a weaker team. They are confident that they can defend a target of 140 runs but still more the merrier. In this match they afford to take risk and send out sloggers in the initial overs. If they didn’t play well, we can replace them with defenders but on chance they slog good, we would stand to score more than 200. In investment parlance, we start saving a fixed amount monthly and would invest that in more risky but better returns instruments. In order to make sure that we achieve the goal we would keep monitoring our returns and if the instruments were not as per out expectations, we would switch to our beloved risk free / low risk instruments.

Consider another goal a non-crucial one, where we don’t mind even if we don’t achieve it. A team already qualified but playing remaining of the matches, winning is good for confidence but won’t affect its standing in points table. In such match the team would like to experiment with variety of different players. This might be helpful to test and spot good players. In investing we would like to try out more exotic instruments like small cap stocks or even future and options. It’s good if they generate good returns but even if it doesn’t we won’t be affected.

Thus, having our goals in place and categorizing them as crucial or non-crucial ones, or variable or fixed can help us to identify the risk appetite and the assets allocation (instrument selection). The benefits of GBI are generally realized when we consider many goals at once. Consider a scenario where we had two goals in parallel, buying a car and going on a foreign trip. The money saved for foreign trip is invested in instruments with better returns. In case we are lucky and get good returns, we might generate more than we require for the trip. We can then use the surplus money to buy even better car than we initially planned. Similar to the IPL season, it’s important to win matches, but while doing so if we can get more overall runs, then that’s a bonus.

How to get started?

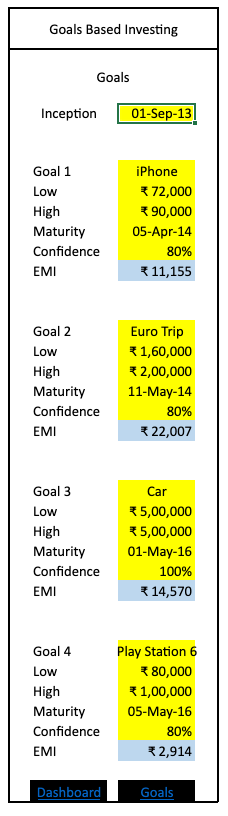

If GBI sounds interesting, and you want to start planning, then reach out to your investment advisor to develop an investment plan. We have developed an excel based model for you to play around some scenarios. This model is based on historical data and thus cannot be used to plan and monitor goals in real time. However, it serves as a good demo to play around with some scenarios and how things would have turned out in past if invested as per GBI. The link to excel model is here, it contains three screens:

Inputs Screen

In the above screen, the user can input up to four goals that they want to plan and deploy.

- Inception date refers to date when the goals were entered, and user began saving for them on monthly basis.

- Low and high refers to the goal amount user wants to accumulate, to accomplish the goal user would want to have minimum of low amount and maximum of high amount, all funds generated above maximum will be transferred to other goals.

- Maturity Date is the date when the funds will be required for goals to be executed

- Confidence refers to how crucial the goal is, all crucial goals should have 100% confidence.

- EMI is the calculated part; it refers to amount the user will have to save monthly to accomplish the goal.

Dashboard Screen:

This screen gives an overview of all the goals. The user has an option to choose current date and look how the investment would be doing at that day. The Market pulse tracks the market on selected date and Goals tracks the funds accumulated, total funds required and current status of each goal.

Goals Dashboard

The progress of each goal can be tracked here. The user can select any mentioned goal here and see in detail how that goal is progressing on any date. Value refers to how much funds have been accumulated till the selected date, and Days refers to how many days have passed since the inception date. Ideally, the value % should be greater than days % as we would like to stay ahead of the time.

Conclusion

The Goals Based Investing approach defines the role of investment as a tool to achieve future financial goals instead of just searching for best returns. Defining goals could start from jotting down the basic ones and adding more to the list as and when we identify new ones. Once the goals are defined and categorized, the planning can be initiated based on each goal. Crucial goals should use safer instruments while goals with some leverage could opt for bit riskier instruments. The performance of these instruments needs to be monitored periodically so that funds could be transferred to safer instruments in case required. Thus, the GBI approach helps to define the risk appetite based on the goals and enhances overall financial health of an individual.

Please use the linked excel workbook to play around with the concept using historical data and let me know your thoughts or suggestions.